A few months ago, the nonprofit organization Resources for the Future sponsored a seminar entitled “The Future of Fuel: Toward the Next Decade of US Energy Policy.” The seminar highlighted the future of five key fuels over the next decade–oil, coal, natural gas, renewables, and nuclear–as well as the future of energy efficiency. The opening remarks were presented by Phil Sharp, president of Resources for the Future. Kristin Hayes, a Center Manager for Resources for the Future, moderated the event and Michael Schaal of the federal Energy Information Administration gave a presentation on energy projections.

One of the speakers was Alan Krupnick, a senior fellow and director of the Center for Energy Economics and Policy at Resources for the Future, who asserted that restricting carbon emissions could significantly slow growth in US shale gas production.

He said, “Fugitive emissions are the biggest issue, and if they are considered too high, it could reverse the potential gains.” He noted that most regulation of shale gas comes at the state level, so it can vary widely across the country. Even states with a long history of oil and gas production, like Texas, are still working out the kinks with some local governments.

On first blush, you may ask, why is that a problem? Consider this: There may be cities or counties within Texas that, from time to time, create restrictions so severe that all oil and gas drilling and production activity is effectively prohibited. However, most of the regulations I am aware of are eminently reasonable. For example, many city or county regulations prohibit oil wells and compressors in residential areas or next to schools. There are good reasons for this. The noise and smell of an actively pumping oil well with an above ground pump, or the noise and smell of a compressor used on a gas well (especially one without a hospital muffler), are substantial. No one could sleep or have any peace near these activities. Secondly, no matter how high the fencing around pumps and other oilfield equipment, they are going to be an attractive nuisance for kids and teenagers and serious injuries or death may result. Thirdly, the location of these activities near homes is going to result in a substantial decrease in the value of those properties. Finally, local cities and counties who have drilling and production activity in residential areas forced upon them are going to find that the diminished value of those homes is going to decrease their tax revenues at a time when they are already struggling.

On first blush, you may ask, why is that a problem? Consider this: There may be cities or counties within Texas that, from time to time, create restrictions so severe that all oil and gas drilling and production activity is effectively prohibited. However, most of the regulations I am aware of are eminently reasonable. For example, many city or county regulations prohibit oil wells and compressors in residential areas or next to schools. There are good reasons for this. The noise and smell of an actively pumping oil well with an above ground pump, or the noise and smell of a compressor used on a gas well (especially one without a hospital muffler), are substantial. No one could sleep or have any peace near these activities. Secondly, no matter how high the fencing around pumps and other oilfield equipment, they are going to be an attractive nuisance for kids and teenagers and serious injuries or death may result. Thirdly, the location of these activities near homes is going to result in a substantial decrease in the value of those properties. Finally, local cities and counties who have drilling and production activity in residential areas forced upon them are going to find that the diminished value of those homes is going to decrease their tax revenues at a time when they are already struggling. The new report was written by the Chamber’s

The new report was written by the Chamber’s  Devon stated it expects this move to save $80 million per year from administrative and personnel expenses. Conversely, the cost of the restructuring and reorganization will cost Devon $125 million. The company has had some problems recently, as Devon posted a net loss of $179 million in the quarter that ended on September 30, 2012. Most of that loss was due to $1.1 billion non-cash impairment charge. Devon indicated that this move will allow it to be more flexible and to quickly move its workforce to wherever it is most needed at any given time. Devon officials also expect the consolidation to increase efficiency by promoting increased sharing of best practices within the home office.

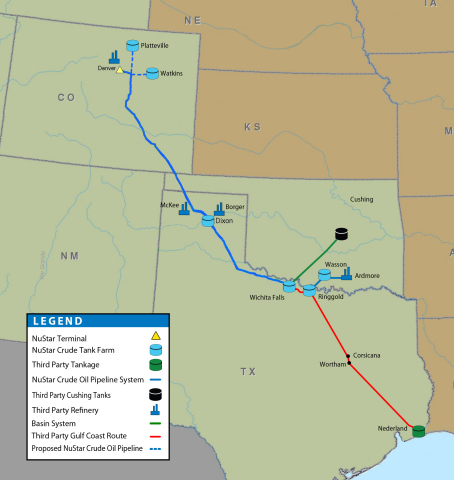

Devon stated it expects this move to save $80 million per year from administrative and personnel expenses. Conversely, the cost of the restructuring and reorganization will cost Devon $125 million. The company has had some problems recently, as Devon posted a net loss of $179 million in the quarter that ended on September 30, 2012. Most of that loss was due to $1.1 billion non-cash impairment charge. Devon indicated that this move will allow it to be more flexible and to quickly move its workforce to wherever it is most needed at any given time. Devon officials also expect the consolidation to increase efficiency by promoting increased sharing of best practices within the home office. To find out what kind of interest exists for this new pipeline project, NuStar held a

To find out what kind of interest exists for this new pipeline project, NuStar held a  Of those surveyed, 75% think the US is already self sufficient in natural gas or will be within ten years.

Of those surveyed, 75% think the US is already self sufficient in natural gas or will be within ten years.