The United States Fifth Circuit Court of Appeals recently published their decision in Holt Texas, Limited and Transamerican Underground, Limited v. Stephen J. Zayler, a case which concerned a bankrupt oil and gas company. Holt Texas, Ltd. (“Holt”) and Transamerica Underground Limited (“TAUG”) who were subcontractors of the now bankrupt T.S.C. Seiber (“Seiber”) appealed the District Court’s judgment which in turn affirmed a Bankruptcy Court order. The District Court held that funds of an interpleader action filed by Encana Corporation (“EnCana”) were not property of Encana but property of the bankrupt company Seiber. On appeal, Holt and TAUG challenged the District and Bankruptcy Courts’ conclusions that first, the Texas Construction Trust Funds Act (“CTFA”) did not apply to these funds, and secondly, that Appellants did not have valid, perfected mineral liens on these funds under Chapter 56 of the Texas Property Code. The Fifth Circuit Court of Appeals vacated the District Court’s judgment and remand for further proceedings.

Background: In 2008 Encana engaged Seiber to build a natural gas pipeline in Robertson County, Texas. Holt and TAUG were the subcontractors; Holt provided heavy machinery and TAUG installed over two thousand feet of pipe. The agreement between Encana’s and Seiber specified that if a subcontractor was not paid by Seiber, Encana would be able to withhold all remaining sums and make no further payment to Seiber. In August 2009 TAUG notified Encana that it had not been paid recently, and would seek payment of the $96,3000 that TAUG claimed it was owed. In September 2009 Encana filed an interpleader in federal district court, paid $345,000.00 into that court’s registry and sought a declaration shielding it from any further liability for the unpaid amounts owed by Seiber. In October 2009 Seiber filed a voluntary petition for bankruptcy relief under Chapter 11 of the Bankruptcy Code, which was quickly converted to a Chapter 7 petition. TAUG then filed an Affidavit Claiming Mineral Lien against Encana’s property in November 2009. Holt filed its Affidavit Claiming Mineral Lien in March 2010. Encana was discharged from the interpleader in April 2012 and a discharge order was entered. The remaining parties filed competing motions for summary judgment: Holt and TAUG argued that two sets of Texas statutes (the Construction Trust Funds Act and the Texas mechanics lien statutes) that are intended to protect subcontractors require that the interpleader funds be awarded to them. The Bankruptcy Court held that neither law applied and that the interpleader funds were part of the bankruptcy estate of Seiber. Holt and TAUG appealed to the District Court, which affirmed the ruling of the Bankruptcy Court. Holt and TAUG then appealed to the Fifth Circuit.

Arguments: The Fifth Circuit discussed whether the interpled funds were property of the bankruptcy estate of Seiber or not. The opinion discussed that this question turns on who had legal possession of the funds after deposit into the registry of the court but before any action was taken by the court as to those funds. Chapter 56 of the Texas Property Code provides mineral subcontractors with a statutory lien “to secure payment for labor or services related to the mineral activities.” Tex. Prop. Code. §56.002. Chapter 162 of the Texas Property Code states that “Construction payments are trust funds under this chapter of the payments are made to a contractor or subcontractor … under a construction contract for the improvement of specific real property in this state.” Tex. Prop. Code §162.001(a). Section 162 protects subcontractors without requiring notice or other action by the subcontractor, such as sending a notice or filing an affidavit.

A federal appellate court decision demonstrates some lessons for Texas mineral owners. That decision was issued by the Fifth Circuit Court of Appeals in the case of Breton Energy, L.L.C., et al. v. Mariner Energy Resources, Inc., et al. The Plaintiffs in this case own and operate an off-shore lease in the Gulf of Mexico that includes an area known as the K-1 sands. The Defendants own and operate an adjacent off-shore lease that covers an area known as the K-2 sands. The Plaintiffs claimed that the Defendants engaged in “unlawful drainage” from the Plaintiffs’ lease in violation of federal and state law.

A federal appellate court decision demonstrates some lessons for Texas mineral owners. That decision was issued by the Fifth Circuit Court of Appeals in the case of Breton Energy, L.L.C., et al. v. Mariner Energy Resources, Inc., et al. The Plaintiffs in this case own and operate an off-shore lease in the Gulf of Mexico that includes an area known as the K-1 sands. The Defendants own and operate an adjacent off-shore lease that covers an area known as the K-2 sands. The Plaintiffs claimed that the Defendants engaged in “unlawful drainage” from the Plaintiffs’ lease in violation of federal and state law.

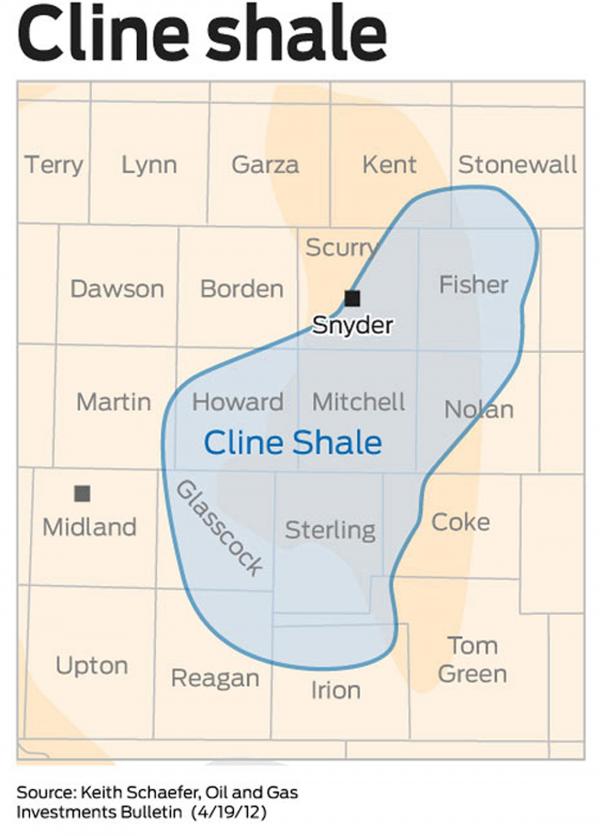

The study estimates that by 2022 the Cline shale will bring more than 30,000 jobs to west Texas and have a $20 billion dollar economic impact. The Cline shale covers less surface area than the Eagle Ford or Barnett, but its hydrocarbons are denser. There is a potential for 3.6 million barrels of oil per square mile to be recovered, for a total of about 30 billion barrels. These numbers indicate that the Cline shale may be larger than both the Eagle Ford and the

The study estimates that by 2022 the Cline shale will bring more than 30,000 jobs to west Texas and have a $20 billion dollar economic impact. The Cline shale covers less surface area than the Eagle Ford or Barnett, but its hydrocarbons are denser. There is a potential for 3.6 million barrels of oil per square mile to be recovered, for a total of about 30 billion barrels. These numbers indicate that the Cline shale may be larger than both the Eagle Ford and the