The rights of Texas mineral owners can be complicated, which is why having a Texas oil and gas attorney review your options is important before you sell or lease your mineral rights or before you buy property in which you will own only the surface.

In many cases, a property owner owns both the surface and the minerals below the surface. However, it is possible to split the ownership, so two different persons or entities own the surface of the land on one hand and the minerals beneath it on the other. In Texas, the owner of the mineral rights has a right to the reasonable use of the surface to produce or extract the minerals, without the permission of the surface owner.

This is where the Texas accommodation doctrine comes in, which is an area of law that is still evolving in Texas. The Texas accommodation doctrine cases hold that, in some cases, the owner of the mineral rights must accommodate the surface owner’s pre-existing surface uses, so long as other means of production or extraction of the minerals are available. It is important to note that this doctrine applies only to the existing surface uses, not possible future uses by the surface owner.

Texas Oil and Gas Attorney Blog

Texas Oil and Gas Attorney Blog

The new report was written by the Chamber’s

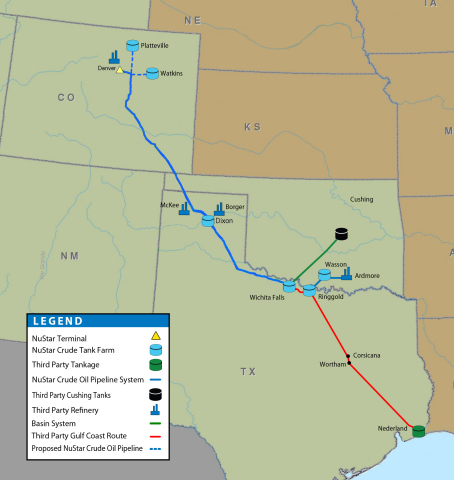

The new report was written by the Chamber’s  To find out what kind of interest exists for this new pipeline project, NuStar held a

To find out what kind of interest exists for this new pipeline project, NuStar held a  Of those surveyed, 75% think the US is already self sufficient in natural gas or will be within ten years.

Of those surveyed, 75% think the US is already self sufficient in natural gas or will be within ten years.  The Cardno study was part of a settlement in 2011 of a lawsuit filed in 2008 against Los Angeles County and Plains Exploration over land use.

The Cardno study was part of a settlement in 2011 of a lawsuit filed in 2008 against Los Angeles County and Plains Exploration over land use.  “If you’re looking for a job, this is the place to be. If you want to relocate, this is the place to be,” said Diane Laplow of San Antonio. There were 48,000 new jobs created by activity in the shale last year. Aside from working directly in the oil and gas industry, this boom is bringing opportunities for small business as well, creating many jobs in other sectors of the local economy. For example, people are opening family businesses, like restaurants, to feed hungry oil workers. “It’s a very good spot to start a business,” said Sarah Cadena, a native of the area whose family now owns a burger and wings joint on a busy highway.

“If you’re looking for a job, this is the place to be. If you want to relocate, this is the place to be,” said Diane Laplow of San Antonio. There were 48,000 new jobs created by activity in the shale last year. Aside from working directly in the oil and gas industry, this boom is bringing opportunities for small business as well, creating many jobs in other sectors of the local economy. For example, people are opening family businesses, like restaurants, to feed hungry oil workers. “It’s a very good spot to start a business,” said Sarah Cadena, a native of the area whose family now owns a burger and wings joint on a busy highway.